Sep 28, · List of Dissertation topics for accounting and finance. Conclusion. Dissertation is a thesis in the form of a document whereby you choose a topic and write your opinions in detail after in -depth research on the subject matter. In the dissertation, the author writes his research, opinions and findings on Estimated Reading Time: 5 mins 1 day ago · DISSERTATION TOPICS FOR FINANCE. When it comes to selecting an amazing dissertation topic, all finance students face difficult decisions. Banking and accounting are essential topics in a wide range of finance fields. We’ve covered the fascinating accounting and finance dissertation topics in this blog Accounting and finance is the lifeblood of any organization and merits quality research. Accounting and finance dissertation topics can be both stimulating and challenging. Research topics in accounting and finance differ in terms of complexity and size. If you are considering dissertation topics in accounting and finance, your study program and size of research required for the program can be Estimated Reading Time: 7 mins

Best Ever Dissertation Topics for Accounting And Finance

This assignment was created by one of our expert academic writers and demonstrated the highest academic quality, dissertation in finance and accounting. Place your order today to achieve academic greatness. Volatility is defined as the statistical measurement of the dispersion in a market index considering the returns Abdalla and Suliman, The central banks and regulatory authorities of stock exchanges have highly focused on volatility modelling and forecasting by using asset pricing models for measuring risks and using option pricing formulas for maximising returns.

The Saudi stock exchange is also known as Tadawul and it was dissertation in finance and accounting in Tadawul has a market cap of SAR 8. The research topic is to conduct an analysis of the impact of financial volatility estimates and option pricing methods on the returns and risk assessment in the Saudi Stock Market.

The research topic has been selected as volatility has become an integral component of the present financial markets and most of the studies conducted by the past authors have focused on the relationship between volatility of the oil prices in Saudi Arabia and the stock prices.

This research will evaluate how the estimation of financial volatility along with using option pricing models can be used for increasing the returns in the Saudi stock market along with conducting a financial risk assessment.

This research will provide more information regarding the dependencies among financial volatility and the Saudi Stock Market along with evaluating the significance of forecasting methods for maximizing gains and minimising risk.

The research will provide the investors with better decision making parameters considering the alterations in returns due dissertation in finance and accounting financial volatility.

This study research aims to evaluate the influence of financial validity extremists and option pricing methods on the returns and risk assessment in the Saudi Stock Market. The research objectives include analysis of the significance of financial volatility modelling and estimates in the Saudi stock market. The research will also contribute in the domain of option pricing models that can be used for evaluating the risk associated with the stock prices for guiding the decision making of the investors.

The present condition of the Saudi stock market along with its dependencies on oil and other commodities will also be evaluated as an objective of this research.

Lastly, the ways in which returns of investment can be maximized in the Saudi stock market by conducting a proper risk assessment by using financial volatility forecasting and option pricing models will also be discussed. This will facilitate the foreign investors to understand the fluctuations in the Saudi stock along with helping the risk manager is and investors to raise awareness about the risk in Tadawul. In Saudi Arabia, dissertation in finance and accounting, the volatility of the stock market and the overall financial industry in the last decade was due to the changes in oil prices.

However, the BASEL accords were updated to implement BASEL III for improving the banking and financial regulations. The stock prices in the nation have been declining since due to the fall in the price of crude oil Kalyanaraman, The government of the country has established a model for Vision by integrating financial forecasting mechanisms to reduce the dependence on oil for the economy Simmons, Volatility is desired in the market as stagnant stock prices do not yield any profits.

However, high volatility also implies high risk for the security, and it is measured by using variance and standard deviation among the returns from the market index. The financial assets have the characteristics of providing returns on the investment but are also susceptible to market risks due to the returns being variable Black, The volatility of the assets remains variable, requiring the forecasting of stocks to analyse the market risk involved.

Examination of the stock volatility is crucial for minimising the risk dissertation in finance and accounting losses while contributing to increasing financial gains. Option pricing methods refer to the parameter of volatility for evaluating the price of the stocks Birge and Zhang, This is beneficial for risk assessment applications and general portfolio management of the stocks.

According to Lim and Sekthe two methods of determining financial volatility forecasting include using the GARCH and ARMA dissertation in finance and accounting. The purpose of this research is to evaluate the impact of estimating financial volatility and option pricing methods on the return on investments and risk assessment in the Saudi Stock Market. This research will be conducted using the positivism philosophy for using first and information for deriving the findings.

The research will be conducted using an inductive approach and considering an experimental design to establish the linkage among the variables in the research topic Saunders et al. The research will be conducted by dissertation in finance and accounting a semi-structured interview with 10 Saudi stock exchange employees to understand the implications of financial volatility forecasting and option pricing models.

The research limitations include time and budget restrictions that inhibit surveying with the investors in the Saudi Stock exchange. The time table relates to the same research is as follows. The research will be conducted by analysing the data collected from the interview by forming a thematic analysis for evaluating the open-ended responses. Secondary data will also be considered in this research for comparing the findings from the immediate reactions. This investigation will identify the measures that are best suited for guiding the investors and financial advisors regarding the maximisation of returns and risk minimisation in the Saudi stock market by using financial volatility estimates and option pricing.

Abdalla, S. Modelling Stock Returns Volatility: Empirical Evidence from Saudi Stock Exchange International Research Journal of Finance and Economics, 85, Bhowmik, R. Stock Market Volatility and Return Analysis: A Systematic Literature Review. Entropy, 22 5 Birge, J. and Zhang, R. Risk-neutral option pricing methods for adjusting constrained cash flows, dissertation in finance and accounting. The Engineering Economist44 1dissertation in finance and accounting, pp. Black, F.

Studies of stock market volatility changes. Kalyanaraman, L. Stock market volatility in Saudi Arabia: An application of univariate G. Asian Social Science, 10 10 Lim, C, dissertation in finance and accounting. and Sek, S.

Comparing the performances of GARCH-type models in capturing the stock market volatility in Malaysia. Procedia Economics and Finance5pp. Saunders, M. and Thornhill, dissertation in finance and accounting, A. Research methods. Business Students 4th edition Pearson Education Limited, England. Simmons, M. Twilight in the desert: The coming Saudi oil shock and the world economy. Search How it works FAQs Offers.

About Us About Us About Us Client Testimonials Our Team Our Writers. Procedures Ordering Process Recruitment Criteria Quality Control Become A Writer Contact Us. All Services All Services Dissertation Services Academic Poster Writing Assignment Writing Custom Essay Writing. All Services Literature Review Writing Presentation Writing Model Answer Writing Reflective Report Writing Statistical Analysis.

All Services Exam Notes Writing Editing And Proofreading Primary Research Service Professional Video Editing Service Coursework Writing. All Services Annotated Bibliography Writing Dissertation in finance and accounting Business Plan Writing Custom Personal Statement Writing Secondary Research Collation Report Writing. Dissertation Services Literature Review Writing Service Dissertation Statistical Analysis Dissertation Chapter Writing Custom Dissertation Topic Ideas.

Samples Of Our Work. Library Library, dissertation in finance and accounting. Plagiarism Plagiarism Checker. Free Dissertation Topics Starting The Research Process Research Methodology Dissertation Writing Guidelines Statistics. Essays Starting The Research Process Essay Writing Guidelines Example Essays.

Harvard Referencing Style. Language Rules. Example Papers Example Essays Example Assignments Example Reports Example Research Papers Example Dissertation Proposals Example Dissertations Example Dissertation Chapters Example Literature Review. Example Papers Example Reflective Report Example Personal Statement Example Research Proposal Example Coursework Example Dissertation Outline. Academic Library. Learn how to draft academic papers.

Check Samples. Review our samples before placing an order. Hire a Writer. Get an experienced writer start working on your paper. An Analysis of the Impact of Financial Volatility Estimates and Option Pricing Methods on the Returns and Risk Assessment in the Saudi Stock Market Introduction Volatility is defined as the statistical measurement of the dispersion in a market index considering the returns Abdalla and Suliman, Reason for Choice The research topic has been selected as volatility has become an integral component of the present financial markets and most of the studies conducted by the past authors have focused on the relationship between volatility of the oil prices in Saudi Arabia and the stock prices.

The Objectives and Expected Research Contribution This study research aims to evaluate the influence of financial validity extremists and option pricing methods on the returns and risk assessment in the Saudi Stock Market. Check Our Samples View All Services. Research Background and Questions In Saudi Arabia, the volatility of the stock market and the overall financial industry in the last decade was due to the changes in oil prices.

The research questions are: What is the importance of financial volatility estimates in the stock markets? In what ways do option pricing models facilitate risk assessment and dissertation in finance and accounting making in the stock market? What is the present condition of the Saudi Stock market considering the dependencies, returns and risk? What is the impact of financial volatility estimates and option pricing methods on the returns and risk assessment in the Saudi Stock Market?

Literature Review The financial assets have the characteristics of providing returns on the investment but are also susceptible to market risks due to the returns being variable Black, dissertation in finance and accounting Methodology The purpose of this research is to evaluate the impact of estimating financial volatility and option pricing methods on the return on investments and risk assessment in the Saudi Stock Market.

Limitations The research limitations include time and budget restrictions that inhibit surveying with the investors in the Saudi Stock exchange. Plan The research will require days or six months to complete. Time Table The time table relates to the same research is as follows.

Finance Research Topics - Topics for Finance - Latest Research Topics l Research Topics in Finance

, time: 4:01Finance Dissertation Topics & Accounting Topics - FREE

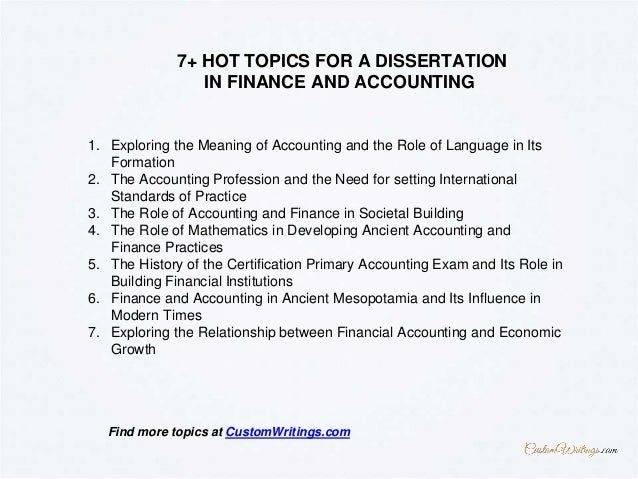

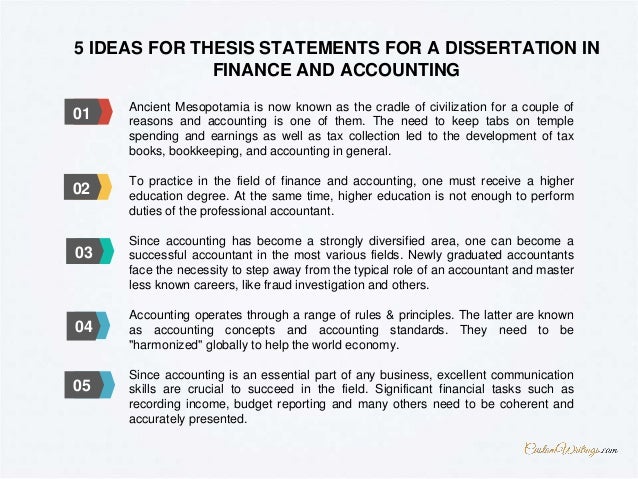

Accounting and finance is the lifeblood of any organization and merits quality research. Accounting and finance dissertation topics can be both stimulating and challenging. Research topics in accounting and finance differ in terms of complexity and size. If you are considering dissertation topics in accounting and finance, your study program and size of research required for the program can be Estimated Reading Time: 7 mins Finance Dissertation Topics & Accounting Dissertation Topics. Choosing a great topic for your finance or accounting dissertation may seem incredibly challenging, especially since the subject can cover such a wide range of different areas. It is important to find a topic that you are passionate about and find genuinely interesting, but is also relevant, manageable, and potentially helpful with regards to Oct 01, · Auditing is an integral part of accounting. You will come across the topic during your course and write a dissertation on the topic. Some important auditing topics are: Effect of internal auditing on financial reporting: internal bias or total compliance. Estimated Reading Time: 10 mins

No comments:

Post a Comment